As modern delivery practices are becoming increasingly adopted within financial services, not only are companies utilizing Agile to improve delivery performance, but they are also recognizing the benefits of Agile when it comes to managing employee’s performance, rendering more traditional models of performance management obsolete. In this article, we aim to highlight the key differences between traditional and new ways of working methods of performance management.

Why traditional performance frameworks no longer work

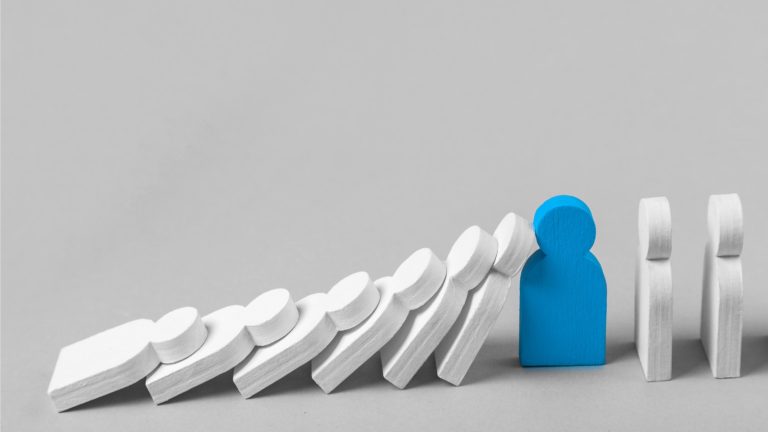

Performance management across financial services is often perceived by employees and management alike to be burdensome, time-consuming, and not an accurate reflection of performance. Whilst there are associated benefits to traditional approaches to performance management, such as providing formal and comparable ratings at an organisation-wide level, they often restrict creativity and collaboration at an individual and group level.

This view is shared by 95 percent of managers across financial services who are reportedly dissatisfied with their current performance management process 1, stating it does not yield accurate information. On the other side of the fence, employees across financial service organisations are repeatedly calling out frustrations with their performance management framework, with 60 percent stating that they do not understand how performance is managed in relation to their peers. Not only that, according to a Gallup report The Dream Job, more than one in three employees have changed jobs within the last three years and 91 percent of those employees left their company to do so. Some attrition is unavoidable but considering the average overall turnover is 18 percent; those numbers are just too high.

Traditional performance management approaches have encouraged many organisations to shift towards an Agile, continuous improvement model, so that the employee will be more likely to perceive appraisals as an ongoing practice.

One size does not fit all

Traditional performance management approaches such as rigid goal setting, annual appraisals and end-of year ratings have encouraged many firms to shift towards an Agile, ‘continuous improvement’ model, so that the employee will be more likely to perceive appraisals as an ongoing practice specifically designed to meet their basic need to feel valued and supported, while being rewarded in experimenting with new ways of doing things. Agile organisations take a people-centered approach, with a means to facilitate on-going one-on-one conversations with continuous feedback loops, not focusing per se on the destination (such as a rating or year-end reviews), but the process of getting there by regularly readdressing objectives and supporting the individual to reach them.

In addition, with recent shifts to remote working, agile performance management would be a great answer to this new world, which requires real-time responses via the many, various communicative tools we now use. These real time communication tools offer a level playing field to everyone if employees are expected to communicate and respond instantaneously, the expectation should be the same for managers around performance conversations.

Focus on the whole employee

Employees are driven by purpose and having managers who actively promote their development. 87 percent of millennials cite access to professional development and career growth opportunities as the most important factors in a job. 6 Organisations must find ways to bring out their employees’ best performance by ensuring they feel a sense of purpose and belonging, while recognizing that their priorities might change often to reflect their life stages or the organisation’s priorities.